|

Thursday, July 23, 2015

Ever since the post-Civil War adoption of the 14th Amendment to the Constitution, all persons born on American soil have been automatically granted citizenship. This policy was common sense in the era it was adopted, a time when international travel was cumbersome and relatively rare, but today its wisdom is being questioned. Is birthright citizenship being abused by people who want to short-circuit America’s labyrinthine immigration law?

The Citizenship Clause of the 14th Amendment states:

“All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.”

From the moment it was adopted, this clause has motivated foreigners to give birth in America. For many years the number of these birth-tourists were limited by the nature of travel, but in today’s world, where air travel drastically cuts down the time it takes to get from one country to another, the path to citizenship guaranteed by the 14th Amendment is well-trod.

Stories abound of pregnant women visiting the U.S. on tourist visas who stay long enough to have their children, get American birth certificates and passports for them, then go back to their native countries, American tot in tow. The Chinese film industry even made a popular romantic comedy about the practice.

Having a child that is an American citizen does not, however, guarantee that the child will grow up in America, or allow the family of the child to stay in this country indefinitely. Unless the parents have legal status in the United States, the entire family must return to their home country. It is not until an American-born baby is 21 that they are able to come to the United States and stay without being in school or having to show that they have a legal guardian here.

Once they reach the age of majority, the birthright citizen can enjoy the full benefits of citizenship, and can even sponsor his or her parents’ applications for citizenship. It is important to remember that having an American-born child is a way to short-cut the system, but will likely take at least 21 years to capitalize on the investment.. In most cases applying for citizenship through other means will be just as fast.

Friday, July 17, 2015

Technology is a double-edged sword. It allows us to work remotely and to have greater flexibility as to where and when we work, but the freedom it affords can also be a burden. When you can work from anywhere, and at any time, it often feels like you should be doing so!

Studies suggest people are caving under the pressure - whether explicit or implicit - to work while technically off the clock. According to the Pew Research Center, approximately 44% of Internet users regularly perform some job tasks outside the workplace.

All the work that is being done outside of work hours is creating a compliance problem for many businesses. The federal Fair Labor Standards Act (FLSA) requires employers to compensate employees that are not exempt from the law for all time worked. These non-exempt employees must all be paid time and a half for all hours worked over 40 per week. This means that employees need to be paid (at overtime rates if applicable) for time spent checking and responding to emails, calls, texts, etc. during non-work hours.

In order to remain FLSA compliant in this technology-driven age, we advise our clients to take the following steps.

Develop a Timekeeping Policy that is Compliant with the FLSA

Explicitly tell your non-exempt employees, preferably in writing, whether or not they are allowed or required to work during non-work hours. Make it clear that “working” includes checking emails and taking phone calls.

Implement the Timekeeping Policy

A policy is not worth the paper it is printed on if it is not actually implemented. Make it easy for employees to report their off-the-clock work, and discipline employees who do not report their off-the-clock time.

Enforce the Timekeeping Policy

When off-the-clock time is reported, pay your employees for it. Be clear about how much, if any, off-the-clock time employees are expected to work, and do not be afraid to discipline employees who do not comply with expectations.

If you have any questions about paying employees for work done off-the-clock or any other business related issue, contact an experienced business law attorney today.

Friday, July 10, 2015

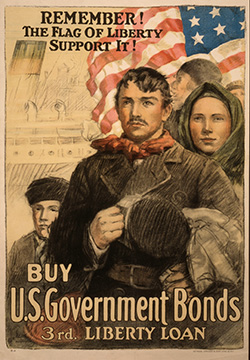

“Give me your tired, your poor,

Your huddled masses yearning to breathe free,

The wretched refuse of your teeming shore.

Send these, the homeless, tempest-tost to me,

I lift my lamp beside the golden door!”

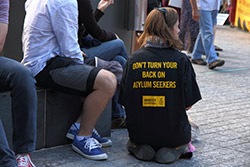

This, according to Emma Lazarus’s famous poem “The New Colossus,” is what the Statute of Liberty cries to the world. It is a reminder that America opens its doors to the most desperate of immigrants, those whose very life is threatened if they return to their home country. In this day and age many of these immigrants are refugees seeking asylum.

A refugee is “someone who is unable or unwilling to return to and avail himself or herself of the protection of his or her country of nationality or, if stateless, country of last habitual residence because of persecution or a well-founded fear of persecution on account of race, religion, nationality, membership in a particular social group, or political opinion.”

There are actually two paths to asylum self-proclaimed refugees can take, known as affirmative and defensive asylum respectively. Which path is appropriate depends largely on the filer’s current immigration status.

Affirmative asylum is available to refugees who have been physically present in the United States for less than a year, regardless of their immigration status. An application for affirmative asylum is filed directly with U.S. Citizenship and Immigration Services (USCIS). If a self-proclaimed refugee has been physically present in the United States for more than a year, he or she can still apply for affirmative asylum if he or she can show that circumstances that materially affect his or her eligibility for asylum have changed, or that extraordinary circumstances delayed his or her filing. He or she must apply for affirmative asylum within a reasonable amount of time given the circumstances.

Defensive asylum, as the name suggests, is a defense to deportation. It is filed with the immigration judge presiding over the self-proclaimed refugee’s removal proceeding.

The key to success in both affirmative and defensive cases is proving the applicant is truly a refugee as defined above. How the evidence is presented depends on the type of asylum.

Affirmative applications for asylum are heard by USCIS Asylum Officers. The process is a non-adversarial interview. Defensive applications are heard by Immigration Judges in adversarial (court-like) proceedings.

If you are in deportation proceedings and/or believe that you may be a refugee, you should contact us now for a consultation in order for us to assist you. Franz Cobos, Esq.

Monday, June 22, 2015

8099.jpg) Commercial Lease Disputes

Sometimes a business grows more rapidly than expected and its leased space is no longer large enough. Other times a business finds itself losing money and unable to pay rent. In those instances, it is the commercial tenant that desires to break its lease. There are times, however, when a commercial landlord seeks to break a lease and even threatens eviction for reasons that may lack merit.

A commercial lease is basically a contract that establishes a relationship between the parties and outlines the respective rights and obligations of each. These documents can be confusing and complex. Resolving a commercial lease dispute often involves business, contract and real estate laws.

Unlike residential leases, where the law heavily favors tenants, in the commercial world, the law tends to be more even-handed. The terms of the lease (even if all you have is an oral agreement) are most often going to be what governs the outcome of the dispute. This reflects the view that both parties involved in commercial lease agreements are sophisticated business entities that can protect their interests.

Since the terms of the lease are most likely going to govern if you file a lawsuit and take your dispute to court, it is essential that anyone evaluating your case examines your lease in depth. Even if an out-of-court settlement is negotiated, familiarity with your particular lease agreement is crucial for anyone advising you. Many commercial leases contain a dispute resolution clause that might require mediation or arbitration. These options can often lead to a resolution in less time and with less expense than traditional litigation.

Assessing damages and amassing the means to prove those damages is another important component to handling a commercial lease dispute. Typically, monetary damages are sought. There might be a clause in the lease regarding attorneys' fees. Again, it is vital that a competent and informed review of your particular lease is made to properly guide your case.

Call us today to discuss your commercial lease dispute and learn what legal options are available. Franz Cobos, Esq.

Thursday, June 11, 2015

Abusive Relationships, Divorce and Immigration

If you are in an abusive relationship but are afraid leaving your spouse will jeopardize your or your children’s immigration status, you are not alone. The law is on your side, and an experienced attorney can help you break free from your abuser’s control and secure your immigration status.

Abuse can take many forms -- physical harm, forced sexual relations, emotional manipulation (including isolation or intimidation), and economic and/or immigration-related threats; the law recognizes this and provides an escape. There are three ways immigrants who become victims of domestic abuse may apply for legal immigration status:

- Self-petitions for legal status under the Violence Against Women Act (VAWA)

- Cancellation of removal (also known as deportation) under the VAWA

- U-nonimmigrant status for victims of crime

A lawyer can help you determine which option is right for you and your children, and help you file the appropriate documents. All of the options above are confidential, so your abuser and other people will not know you have applied unless you tell him or her.

Marriage is not supposed to be a trap. Your immigration status should not prevent you from leaving a relationship that is harmful to you or your children.

If you or your children are in immediate danger, do not hesitate to call 911. Tell the police what you fear is about to happen, and be prepared to tell them about any abuse that has happened in the past. The police may arrest your spouse, and/or other people, if a crime has been committed. Once you are out of harm’s way, you can seek legal assistance from an attorney to help you gain a more permanent solution to your problems.

If you are not in immediate danger, it is a good idea to reach out to an attorney with experience handling these types of cases as this can be a confusing area of law. Having someone that can guide you along the way is critical.

Monday, June 1, 2015

10 Things to Bring to Your First Meeting With Your Attorney

Hiring an attorney is not something most people do every day, so being a little bit unsure of how things are going to go is perfectly normal. To help ease some of the stress and make the process go more smoothly, take time to compile and bring the following list of items with you to your first meeting.

- A list of all your contact information. Your lawyer is going to need to know your full legal name and any other names you go by, your address, phone number(s), and email address.

- The names and contact information of other people that might get involved with the case - people on the other side, people on your side, witnesses, doctors, police, insurance agents, etc. If a case has already been filed against you, the name(s) and contact information of the lawyer(s) representing the other side will also be needed.

- A typed up or written down account of the circumstances surrounding the situation that is causing you to seek legal help. Try to make your summary of events as detailed as possible. If writing or typing isn’t one of your strengths, try creating an audio recording.

- A timeline of events. The best way to do this is to buy a calendar, write all the important events on it, and bring it to the meeting with you.

- Any materials (including documents, digital files and photos) you have that relate to your legal matter. If possible, put the documents in an order that makes sense when paired with the summary of events and timeline you put together above.

- A list of information (particularly documents) you wish you had or thought you had but can’t seem to find now.

- The truth. You don’t have to swear to tell the truth, the whole truth, and nothing but the truth unless you are taking the witness stand in the courtroom, but lying to your attorney will not help your case.

- Bring a good idea of what you hope to get out of the case. Think about what winning looks like to you. It is difficult for your attorney to figure out how best to help you if they don’t know what you want.

- An open mind paired with a good sense of what your gut is telling you. Your lawyer may suggest a solution that you would never have imagined, or let you know that you don’t have a case. Listen to what they tell you, but don’t be afraid to share your thoughts on their suggestions.

- A list of any questions you have. The meeting will be far more productive if you leave without nagging questions or lingering doubts.

We are here to help. Call us for a consultation. Franz Cobos, Esq.

Saturday, May 30, 2015

Mediation & Alternative Dispute Resolution ("ADR") Options in Divorce

My spouse and I would like to pursue an amicable divorce, and would like to stay out of court if at all possible. Are there alternative methods to divorce resolution?

With the dawning of no-fault divorce in New York and New Jersey, couples looking for a more amicable, less-stressful dissolution experience may be able to achieve such results through the use of alternative dispute resolution. Namely, mediation and collaborative divorce models have proven wildly successful in New York and elsewhere, allowing families the opportunity to transition their family dynamics with dignity and grace, as opposed to name-calling and vitriol.

Collaborative divorce

As the name suggests, a collaborative divorce is one in which all parties agree to forgo litigation (i.e., court intervention) in lieu of working together to arrive at a practicable solution. Issues ranging from spousal support to child visitation are negotiated in a non-adversarial environment, and parties are encouraged to work together – as opposed to in opposition – to arrive at a settlement agreement that meets the needs of the family as a whole. Collaborative divorce relies on the mutual agreement by both spouses to engage in full disclosure during all negotiations, as well as treat all parties involved with respect.

Mediation

As a component of the traditional divorce model, mediation is often used when parties are stuck on a particular issue, and is designed to avoid the costs and time investment of full-blown litigation. In lieu of the formal adversarial process, parties are seated at a table before a neutral third party. This third party will then work with both sides to determine the most important factors at play, as well as offer solutions for both parties to consider. If, at the conclusion of the session, an agreement cannot be reached, parties may seek Court intervention to resolve their conflicts. Benefits The benefits of mediation and ADR approach allows both parties to be cognizant of the main issues in conflict. The matter, being streamlined and focused, permits a more fruitful Court determination in the event Court intervention is necessary. We are here to help, call us for assistance. Franz Cobos, Esq.

Saturday, May 30, 2015

Non-citizens believed to be in the country illegally can be taken into custody and held by the Department of Homeland Security’s (DHS) Immigration and Customs Enforcement (ICE) branch. Just like in the criminal law system, detainees may be given the option to post a bond and be released from detention while they await judgment.

A bond is a monetary promise that the detainee will comply with the government’s demands and show up when required if they are released from custody. A bond is not a fine; it does not put an end to the issue at hand, it merely allows the detainee to live at home rather than in government custody while his or her case is processed.

Whether a bond is available and how much it will be depends on several factors. The minimum amount ICE can set for a bond is $1,500, but it can be set at a much higher rate as well. ICE will take into consideration the length of time the detainee has lived in the United States, whether he or she has family in the United States, the detainee’s employment history and criminal record, and whether the detainee has any past immigration law violations. There is no way to predict exactly what amount ICE will set a bond at, but an experienced attorney can provide a likely range.

If the detainee thinks his or her bond is too high, he or she can appeal ICE’s decision to a judge. Once the bond is finalized, it can only be challenged if the detainee’s circumstances change. For example, if the detainee has a criminal charge pending when bond is set that is later dismissed, the detainee can ask that bond be lowered.

While it is the detainee that might be challenging the bond amount, the detainee is not usually the one paying the bond. Immigration bonds must be paid by someone who is in the country legally. This can be a relative, friend or professional bondsman; it doesn’t matter as long as the person can prove he or she is in the country legally and can provide the government with a cashier’s check in the bond amount.

If all the government’s conditions are met, the bond money is returned to the lender at the close of the case. It does not matter if the detainee wins the case and gets to stay in the United States or loses and is deported; if the detainee always appeared when required by ICE, the bond money is returned.

If you or your loved one is involved in an immigration matter, call us, we have the expertise you need. Franz Cobos, Esq.

Saturday, May 30, 2015

7632.jpg)

Top Ten Child Support Myths

Child support disputes can bring out the worst in many parents, conjuring images of greedy ex-spouses and children who are used as pawns in games of parental posturing and revenge. While there may be a certain degree of truth to some of the stereotypes, there are many myths that are prevalent in the context of children and divorce.

Myth: Child support payments are based on the needs of the children.

Fact: Support payments are based on the parents’ ability to earn income and have no basis in the actual costs to raise a child.

Myth: Child support payments must be spent on the child.

Fact: No state requires child support recipients to account for expenditures or prove they were necessary to meet the child’s needs, or even whether they were spent on the children at all. In fact, many states view the purpose of child support as protecting the standard of living of the custodial parent.

Myth: I can move out of state to dodge my child support obligations.

Fact: Each state has its own child support enforcement agency and these agencies all work together. You cannot escape this obligation.

Myth: I can quit my job in order to avoid making child support payments.

Fact: The courts are permitted to “impute” income to a parent who intentionally quits a job, whether or not that parent is currently earning a paycheck. Obligations will continue to accrue and payments must be made.

Myth: I have lost my job and can’t make my child support payments, so I will be sent to jail.

Fact: You can only be incarcerated if you have the ability to pay but refuse to do so. If you have lost your income and do not have the ability to pay, you will not be criminally liable for non-payment.

Myth: My ex-spouse uses child support payments for shopping, dining and to support a lavish lifestyle; therefore, my support payment should be reduced.

Fact: So long as the custodial parent pays expenses to feed, clothe and house the minor children, which is the ultimate purpose of child support payments, whatever else she spends money on is generally not scrutinized.

Myth: My living expenses are high and I cannot afford the child support payments; therefore, my support payment should be reduced.

Fact: Generally, expenses must be necessary and extreme in order to be considered as a basis for child support calculations.

Myth: Child support payments are deductible on my income taxes.

Fact: Child support payments are not deductible to the paying parent; nor are they considered “income” to the receiving parent.

Myth: If I have children with a new partner, my child support payments will decrease.

Fact: The birth of a new child will not reduce your obligations to make child support payments to a prior spouse. New children may affect the existing child support order if you get another divorce and must pay child support for the second set of children.

Myth: My ex-spouse claims she can modify the child support order and take my house, bank account or other assets.

Fact: A future child support modification can only address the amount of child support payments going forward. Assets cannot be seized and typically are not considered in modifications.

We are here to help. Call us for a consultation. Franz Cobos, Esq.

Thursday, April 30, 2015

8939.jpg)

When you file for Chapter 7 or Chapter 13 bankruptcy in the United States, a bankruptcy trustee will be appointed to administer your case. The role of the trustee will vary depending on whether you file for Chapter 7 or 13 but his or her primary responsibility is to represent the bankruptcy estate which consists of all of your assets that will be used to satisfy the claims of creditors.

Chapter 7

In the case of a Chapter 7 Bankruptcy, the trustee will review your bankruptcy petition and verify that all information provided is accurate based on the various documentation and calculations that you have submitted. Shortly after you file the petition, the trustee in your case will conduct a 341(a) meeting of creditors which you must attend. Creditors are welcome to attend this hearing (although they often do not) where the trustee will ask you questions about the information contained within your filing. All questions are asked under oath and are meant to serve as further verification of your current financial situation. After the hearing, the trustee will assess and liquidate all of your nonexempt assets to pay your creditors and satisfy outstanding debt.

Chapter 13

As with Chapter 7, the trustee in a Chapter 13 bankruptcy will review the petition and accompanying documentation such as paystubs and monthly bills. When filing for Chapter 13, you will also need to submit a payment plan which your trustee will also carefully review taking into account your income, expenses and debt. If a trustee feels you are able to pay more than proposed, he or she may object in order to maximize the return to creditors. Similarly, he or she may propose lower payments if your proposed terms are not reasonable. As is the case with Chapter 7, a trustee in a Chapter 13 case will also hold a creditor hearing where you will testify under oath about all information contained within your bankruptcy petition. This meeting generally happens about a month after the filing.

After the hearing, creditors are required to file a proof of claim. The trustee in a Chapter 13 case must review all of these documents and may ultimately object to the claims if they fail to provide proper supporting documentation. Once the repayment plan has been finalized, the Trustee will begin distributing funds to creditors. It’s important to note that as soon as you submit your payment plan to your trustee, you must make the proposed monthly payment; however, these funds won’t be distributed until the plan has been finalized and approved. For the duration of the payment plan (3-5 years), all payments will continue to be made to the trustee; you do not pay your creditors directly.

As you work through your bankruptcy, it’s important to remember that the trustee assigned to your case is not on your side or on that of your creditors. Instead, they are to be objective third parties assigned to your case to ensure that your debts are satisfied in a fair manner. An experienced bankruptcy attorney, on the other hand, is your dedicated advocate, ensuring your interests are protected. If you are considering bankruptcy, it’s important that you first consult an attorney who has experience working with trustees and helping individuals just like you get back on their feet. Call us for a consultation.

Thursday, April 16, 2015

3907.jpg)

Most Legal Issues Can Be Resolved Before They Even Arise. Here’s How.

Most people are familiar with the idea of “preventative” legal action. The term refers to anticipating legal issues and conflicts and working to prevent them, rather than solving them or “winning” them once they occur. Companies can benefit from implementing preventative legal strategies as this approach is often less expensive than litigation, mediation, arbitration, and local, state and federal fines.

By working with an attorney early on in the creation of your new business, you can build a sound foundation for your company while likely saving money down the road. The following steps can serve as a great starting point for sound legal planning:

- Establish a relationship with an attorney who can assist you with the legal issues your new business will face early on in the start-up process. When an attorney is familiar with your firm from the onset, he or she can more effectively anticipate and address legal challenges and provide solutions.

- Determine what you want, negotiate it and memorialize it in proper legal documents. Businesses encounter disagreements with vendors, landlords, employees, partners and others. To minimize the number of conflicts, it’s important to establish written contracts for all important agreements, arrangements and accommodations.

A business law attorney can help you identify all key concerns regarding employee compensation and benefits, property usage and maintenance, relationships with suppliers and responsibility and profit sharing with partners. An attorney can ensure that, when a question, disagreement or conflict arises, your interests are written down, clearly stated and legally protected by a mutual agreement with the party in question.

- There are many exciting steps in starting a new business venture; selecting the type of legal entity the business will be is rarely one of them. Yet, it’s important to select a business structure early. Corporations offer numerous advantages but also require officers, boards, articles of incorporation and other formalities. Partnerships and sole proprietorships are simpler than most other business structures but open owners to potentially costly liability. Limited liability companies offer a middle ground for many, providing a liability shield and comparative simplicity. We can help you determine which business structure will work best for you by taking into account tax planning, location and other key considerations.

Even with preventative legal planning, a lawsuit may arise. If it does, it’s important to approach it from a business, not a personal standpoint. This strategy can help you make decisions that are best for your company’s future, keep your focus on the day-to-day needs of your business and avoid unnecessarily disclosing information. For legal advice and hands-on assistance during the formation and continued operation of your business, contact us for a consultation.

|

|

|

|